EQ: Modernising Legacy Systems to Sustain Market Leadership

The Challenge

EQ Retirement Solutions, the UK's leading pension administration outsourcer (and part of the Equiniti Group), identified an opportunity to transform their customer guidance operations to enhance service delivery and unlock new revenue potential.

The existing process for delivering guidance calls needed modernisation to meet rising market expectations and maintain EQ's competitive edge.

The company identified five critical areas for improvement:

- Data Quality: Manual processes and multiple systems created inconsistencies in data capture

- Service Efficiency: Complex operational processes impacted guidance call handling times

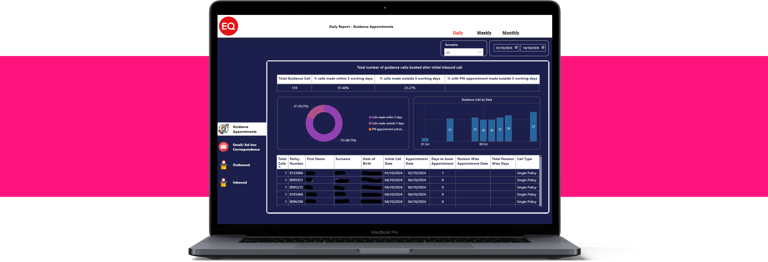

- Performance Visibility: Operations managers needed streamlined reporting capabilities

- Client Experience: Multiple manual solutions affected service consistency

- Financial Growth: Operational complexity limited revenue optimisation opportunities

These interconnected challenges demanded a comprehensive solution that would transform their entire service delivery model while ensuring strict regulatory compliance.

The Solution

EQ reimagined their customer guidance service through a comprehensive digital transformation programme leveraging Microsoft Power Platform, Power BI, PowerApps, Azure and some custom .NET code.

Their vision focused on creating a slick, integrated digital tool that would revolutionise service delivery. This platform combines cutting-edge technology with robust compliance measures, delivering an enhanced experience for both customers and operators.

The solution modernises service delivery while maintaining strict regulatory compliance, enhances operational efficiency through automated processes, and strengthens stakeholder relationships through improved service quality.

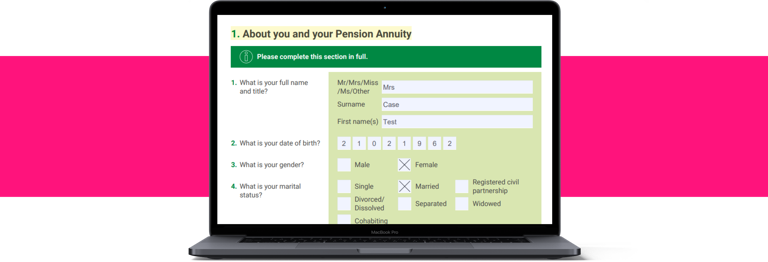

The key technical components of our solution included automated PDF application form filling, seamless integration with Outreach and Office 365 bookings, and custom Microsoft Power BI reporting dashboards for deeper insights. Additionally, enhanced security measures are in place to minimise data breach risks, ensuring robust protection.

Etch's digital transformation expertise has revolutionised our operations at EQ Retirement Solutions. By modernising our legacy systems with Microsoft technologies and implementing an automated and robust work management system, we've improved service delivery, reduced transaction handling times for pre-populating OMO PDF templates by more than 70%, and unlocked new revenue opportunities. This partnership has been crucial in maintaining our market leadership, driving sustainable growth, realising efficiencies, and mitigating risk, all while supporting positive service delivery and MI production.

— Jon Wilson - Head of Operational Delivery, EQ Retirement Solutions

Methodology

The transformation followed a structured two-phase approach that brought together expertise in Strategy, UI, UX, Engineering, and Delivery.

The initial phase focused on building strong foundations for transformation:

Phase Zero: Strategic Vision Definition

- Mapping current service flows, pain-points and opportunities

- Developing and testing prototype solutions

- Creating customer journeys for multiple operational personas

- Establishing a comprehensive investment roadmap

- Crafting high-level technical definitions for governance approval

Phase One: Transformation Operationalisation

Over a focused 26-week implementation period, EQ brought their vision to life through systematic development, supported by Etch's expertise across engineering and infrastructure.

The programme delivered a fully integrated digital solution including:

- Custom integration with existing enterprise systems

- Sophisticated PowerApps solution with PowerBI reporting interface

- Automated document processing capabilities

- Comprehensive training and knowledge transfer programmes

- Future-ready product roadmap for continued evolution

Impact

The transformation has delivered significant value across multiple dimensions:

- Reduced average handling time for transactions by 70%

- Created a single source of truth for applications

- Eliminated operational challenges with service outages

- Provided holistic view of demand across the servicing portfolio

- Improved control and confidence in data quality

- Enhanced security and accuracy through automation

- Achieved target margin improvements

- Delivered better customer outcomes

Most importantly, the transformation has created new revenue opportunities that position EQ for sustainable growth.

Achievements

Reduced average handling time for transactions by 70%

Created a single source of truth for applications

Enhanced security and accuracy through automation

Looking Forward

EQ continues to lead innovation in retirement solutions, with a clear roadmap for ongoing enhancement of their digital capabilities.

This transformation demonstrates how established financial services organisations can successfully modernise their legacy operations while maintaining the highest standards of service and compliance.

To explore how emerging technologies can give your business an edge, visit our website or contact us today.

We help established businesses unlock their full potential and regain market leadership through our proven EtchElevate™ process.

EtchElevate™. Transform CX. Accelerate Growth. Reduce Costs.