The gaming industry is poised for dramatic change. In this week’s article, we’ll be examining the trends, and look at what the future of the gaming industry might hold from a vendor and developer perspective.

They’re here. After seven years of the eighth generation of home consoles, it’s time to move to new ones. The Xbox Series consoles launched on Tuesday, 10th of November and the PlayStation 5 launched on Thursday the 12th, with a UK launch to follow next week at time of writing.

Whilst each console promises boosted graphical fidelity, faster loading times and a refreshed console experience, we’re looking at a more contentious, fascinating question: Will these be the last consoles of their kind? By examining marketplace data, we can start to imagine how the face of the gaming industry might change drastically in the years to come.

The state of the union

Anecdotally, demand for these machines seems incredibly high. Both sold out their initial pre-orders, and while the manufacturing numbers may have been reduced by COVID-19 and the impact it has had on the global workforce, it feels like there’s a real appetite for new hardware. In the PC space, new lines of graphics cards are selling extremely well. A survey by market-research company VGM found that in the United States, 81% of the general gaming population surveyed intended to purchase or attempt to purchase a “next-gen” console in 2020.

By comparison, current demand for new ways to play is relatively low. Despite investment from big players like Google, Amazon and Xbox-owners Microsoft, streaming of playable games (also known as ‘cloud gaming’, either directly to your TV or to a lower specification gaming device like an Android phone) is seen as a novelty. The technology has progressed and matured massively in the last few years but has yet to break through in a way that could be considered a real success. There is, as yet no household name for game streaming, no clear winner.

If there were, it would likely be Microsoft’s Game Pass service, a subscription service which offers access to a large library of games. It has proven to be a major disruptor of the ways that customers can “purchase” games, and now seems intent on taking that mission further. Streaming on Game Pass is currently only available on Android phones and launched in September of 2020.

Seven years is a long time

Given the current state of the industry, and the challenges surrounding streaming services: Vendor buy-in, internet speed, and a consumer base which is often hard to please, to name a few – you’d be forgiven for considering it unthinkable that consoles as we know it might not exist after this generation.

But if 2020 has taught us anything, it is that a year – geo-politically, economically, and socially – can be a very, very long time. If this generation lasts as long as the previous, seven years will take us to 2027.

A lot can change. A lot does change.

The need for speed

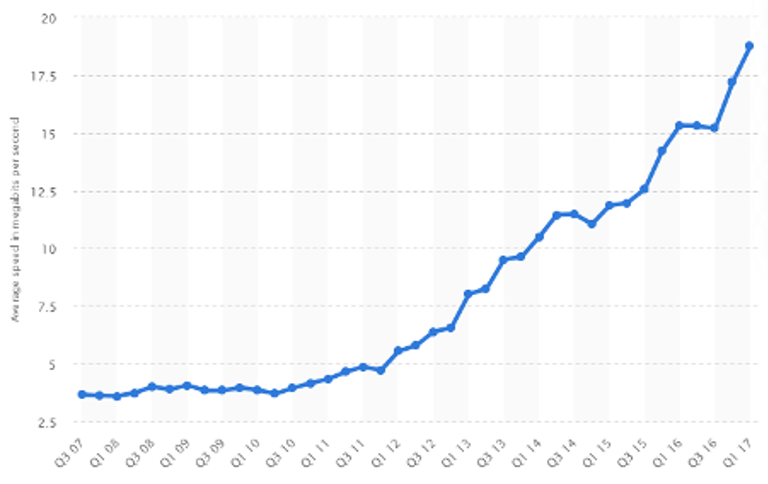

Take a look at this graph, which charts average internet speed of home internet in the United States. I’ve chosen the US here because as well as being an enormous market, the US is fairly average, as internet speeds go. They have some good speeds, and some places with very poor speeds. Overall, not great, not terrible. Think of them as the lowest common denominator – many countries have better internet than this (Not Australia though. Sorry Australia.)

This graph charts the rise of internet speeds, previously a blocker to streaming content. Back in 2007, Netflix had just delivered their billionth DVD and began to focus on streaming video, but speeds back then were a challenge. They didn’t launch streaming in the United Kingdom and Ireland until 2012.

The trends in home internet have continued. Last year, the United States average Mbps had risen to 124. This year, at time of writing, the average is 161Mbps, a reflection both of continual growth but also that the COVID-19 pandemic has encouraged bigger investment in internet infrastructure. Furthermore, most countries have begun building 5G networks. 5G is cellular data but with incredible speed, several times faster than 4G and able to rival fibre connections. What’s more, I look forward to someone re-reading this blog in 10 years' time and laughing at my suggestion that 5G is ‘incredible’. Our appetite for information is vast, our time is precious, and the speeds of the future will put our current setups to shame.

Consumer behaviour

If we assume then, that the infrastructure to support cloud gaming is going to improve (and likewise, the internal capabilities of the teams at major companies like Amazon will continue to innovate in this space) – what about the way people behave?

When the Xbox One was first announced, Microsoft touted several ‘always-online’ features - taking advantage of cloud computing, but also restricting consumers by moving towards a model that focused on digital sales, removing pre-owned and borrowed games from the market. The gaming community responded loudly and clearly: We don’t want this. It isn’t the first time that the demographic has been stand-offish, and it likely won’t be the last. It is however interesting to note that 7 years later, nudged by the pandemic, we have finally reached the point where digital sales are more popular than physical.

The most ardent fans of gaming have very specific ideas about what they want out of a console, or a PC designed for gaming, and these attitudes are likely going to be slow to change. But there are parallels, and what they highlight is that the driver of change is mostly a matter of economics.

Let’s take music as an example. There are, and will likely always be, a subset of music consumers who want to buy music on vinyl. It’s arguably the highest quality way to engage with something that they love, with no compromises. Vinyl has even had a resurgence over the last few years! But to tell the story of vinyl in the 2000’s without any other context would also fundamentally miss the real story of what has happened to music consumption more broadly over that same time period.

First, we transitioned to digital sales. Then, when the technology allowed, the general public, en-masse adopted music streaming. In both cases convenience is a factor, but a critical component is also price. We went from paying £12.99 for a CD, to £7.99 for an album on iTunes, and finally to £9.99 a month for unlimited access to millions of songs and albums on services like Spotify.

I mentioned Netflix earlier in the article, and television/film went through a similar transition. Although it has changed somewhat by the nature of pre-existing terrestrial TV in the UK, ultimately services like Netflix offer us better value than cinemas and DVDs, and more convenience.

This process has begun in games, in earnest with the aforementioned Game Pass which has already radically altered how many consumers decide what games to buy. Much like trying a song on Spotify or trying a movie on Netflix, there’s a lower barrier to entry. Game Pass players play more. They play a wider variety of games than they would otherwise. They get cheaper access to things they would’ve bought, too. It doesn’t feel like a stretch to say it: Game Pass is pretty good, you guys. It’s good!

But there are two barriers which remain for most players on Game Pass: Having to own an expensive, sophisticated bit of hardware, and the download sizes/times. By adding streaming to Android as an option, they’ve begun to remove those final walls, and history tells us that consumers (most of them anyway) will switch to something more convenient and equitably priced fairly quickly, once a service builds momentum. Will streaming be good enough quality for this to be the most convenient and best way to play? How long will it take? For many, that time is fast approaching. But it does appear to be a question of when, not will.

The new frontier

Gaming is a business, and companies like Sony, Microsoft and Nintendo are in competition with each other. With cloud gaming now on the horizon as a potential future trend worth billions of dollars, we’re seeing new big players like Google and Amazon enter the fray, armed with money and teams full of very smart people. Companies like NVIDIA, Ubitus and Blade already operate successfully in this market and expect to grow.

Like the Netflix of 2007, these companies see the potential future ahead of them. The only thing that will stand in their way, will be each other. One of the biggest news stories of the year was Microsoft acquiring Bethesda, a deal worth over 7 billion US dollars. It is unlikely to be the last such acquisition, aimed at securing content and preventing it from appearing on other services.

Apple (who may make further moves in this space in their own right) have thus far stymied any attempts to launch streaming apps for games on their platforms, from both Google and Microsoft. In the months to come, with various legal systems looking at Apple and pondering the words “anti-trust”, these companies will turn to the relatively open standards of the web and use browsers to launch services on iOS. Apple will put up a fight but might eventually relent here, whether due to legal pressure or because they do not want to lose iPhone users to rival platforms as cloud gaming becomes a bigger factor when customers make purchasing decisions.

Both Sony and Microsoft can be expected to launch “half-step” consoles during this generation, offering the same console but with a variety of minor improvements that might see the new version branded as a “Pro” edition, or a “Slim” version which takes up less space on your shelf. The appetite for these, compared to what we expect will be a growing cloud gaming market, will be a good indicator as to how this cloud gaming market is progressing – will they still be hot-ticket items, or will interest in them wane compared to new offerings? Microsoft are trending towards an “Xbox family” of devices, all capable of playing the same games, a savvy move which positions them well to pivot as necessary during the process.

If the word ‘positioning’ makes it sound like a game of chess, that’s because in some ways, it is. Again, we only have to look at similar industries to see how this might play out. Disney+. HBO Max. Hulu. Amazon Prime Video. For consumers, the choices when it comes to video streaming are becoming overwhelming, and we can expect similar in the videogames space, with platforms vying for supremacy. It’s likely to be a battle royale, albeit with several left standing to provide long term competition and hopefully benefit the industry as a whole by encouraging further innovation.

The only questions that remain are: Who will succeed, and how long will it take them?

The last of them

Revenue from streaming of playable games was estimated to be worth 170 million dollars in 2019. Newzoo project that by 2023, some three years short of the likely end of this generation, that this market will be worth 4.8 billion dollars. If that kind of growth continues, then the market will be worth much more by the year 2027. The next seven years promise a revolution in internet speeds, truly unlocking the potential of cloud gaming. And all the relevant companies are preparing for war, ready to fight for their slice of the pie with aggressively priced services and slick marketing. Consumers will eventually pick sides, and they’ll change their behaviour, as the value proposition and convenience equation tips in their favour.

Or at least, that’s the theory.

Nobody can really predict the future. A year is a long time, and that goes both ways. Seven is almost unfathomable, and the generation could be even longer. But if these trends continue, that console you buy this Christmas? Well, it might just be the last of its kind. The last true home console that you ever buy.

To discuss the rapidly-evolving state of the games industry, discuss your product strategy, or invest in resilient methods of engagement and retention for your gaming business as the future unfolds, get in touch with Etch Play. Etch Play are the digital agency for the games industry. We build meaningful connections and maximise every player interaction with your games.